This post will be a quickie detailing a rather annoying…finding about the pandas package in Python.

For those not in the know, I’ve been taking some Python courses, trying to port my R finance skills into Python, because Python is more popular as far as employers go. (If you know of an opportunity, here’s my resume.) So, I’m trying to get my Python skills going, hopefully sooner rather than later.

However, for those that think Python is all that and a bag of chips, I hope to be able to disabuse people of that.

First and foremost, as far as actual accessible coursework goes on using Python, just a quick review of courses I’ve seen so far (at least as far as DataCamp goes):

The R/Finance courses (of which I teach one, on quantstrat, which is just my Nuts and Bolts series of blog posts with coding exercises) are of…reasonable quality, actually. I know for a fact that I’ve used Ross Bennett’s PortfolioAnalytics course teachings in a professional consulting manner before, quantstrat is used in industry, and I was explicitly told that my course is now used as a University of Washington Master’s in Computational Finance prerequisite.

In contrast, DataCamp’s Python for Finance courses have not particularly impressed me. While a course in basic time series manipulation is alright, I suppose, there is one course that just uses finance as an intro to numpy. There’s another course that tries to apply machine learning methodology to finance by measuring the performance of prediction algorithms with R-squareds, and saying it’s good when the R-squared values go from negative to zero, without saying anything of more reasonable financial measures, such as Sharpe Ratio, drawdown, and so on and so forth. There are also a couple of courses on the usual risk management/covariance/VaR/drawdown/etc. concepts that so many reading this blog are familiar with. The most interesting python for finance course I found there, was actually Dakota Wixom’s (a former colleague of mine, when I consulted for Yewno) on financial concepts, which covers things like time value of money, payback periods, and a lot of other really relevant concepts which deal with longer-term capital project investments (I know that because I distinctly remember an engineering finance course covering things such as IRR, WACC, and so on, with a bunch of real-life examples written by Lehigh’s former chair of the Industrial and Systems Engineering Department).

However, rather than take multiple Python courses not particularly focused on quant finance, I’d rather redirect any reader to just *one*, that covers all the concepts found in, well, just about all of the DataCamp finance courses–and more–in its first two (of four) chapters that I’m self-pacing right now.

This one!

It’s taught by Lionel Martellini of the EDHEC school as far as concepts go, but the lion’s share of it–the programming, is taught by the CEO of Optimal Asset Management, Vijay Vaidyanathan. I worked for Vijay in 2013 and 2014, and essentially, he made my R coding (I didn’t use any spaces or style in my code.) into, well, what allow you, the readers, to follow along with my ideas in code. In fact, I started this blog shortly after I left Optimal. Basically, I view that time in my career as akin to a second master’s degree. Everyone that praises any line of code on this blog…you have Vijay to thank for that. So, I’m hoping that his courses on Python will actually get my Python skills to the point that they get me more job opportunities (hopefully quickly).

However, if people think that Python is as good as R as far as finance goes, well…so far, the going isn’t going to be easy. Namely, I’ve found that working on finance in R is much easier than in Python thanks to R’s fantastic libraries written by Brian Peterson, Josh Ulrich, Jeff Ryan, and the rest of the R/Finance crew (I wonder if I’m part of it considering I taught a course like they did).

In any case, I’ve been trying to replicate the endpoints function from R in Python, because I always use it to do subsetting for asset allocation, and because I think that being able to jump between yearly, quarterly, monthly, and even daily indices to account for timing luck–(EG if you rebalance a portfolio quarterly on Mar/Jun/Sep/Dec, does it have a similar performance to a portfolio rebalanced Jan/Apr/Jul/Oct, or how does a portfolio perform depending on the day of month it’s rebalanced, and so on)–is something fairly important that should be included in the functionality of any comprehensively-built asset allocation package. You have Corey Hoffstein of Think Newfound to thank for that, and while I’ve built in daily offsets into a generalized asset allocation function I’m working on, my last post shows that there are a lot of devils hiding in the details of how one chooses–or even measures–lookbacks and rebalancing periods.

Moving on, here’s an edge case in Python’s Pandas package, regarding how Python sees weeks. That is, I dub it–an edgy panda. Basically, imagine a panda in a leather vest with a mohawk. The issue is that in some cases, the very end of one year is seen as the start of a next one, and thus the week count is seen as 1 rather than 52 or 53, which makes finding the last given day of a week not exactly work in some cases.

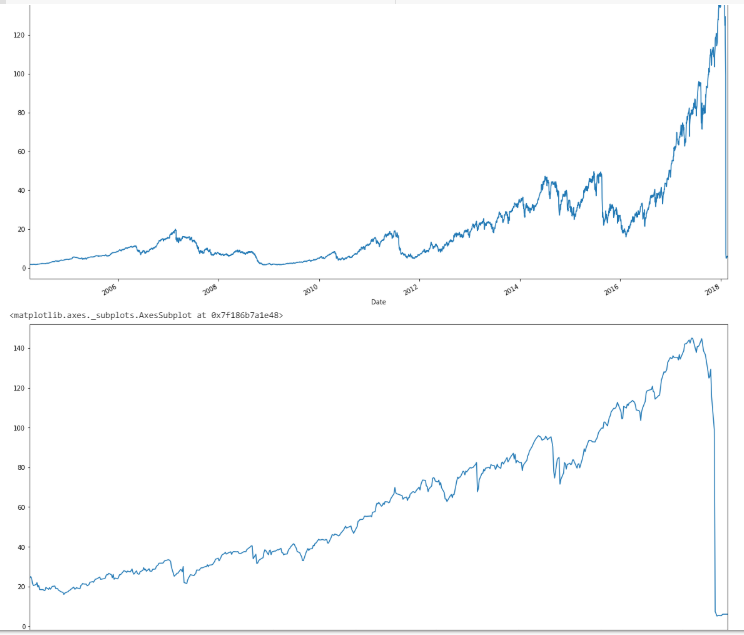

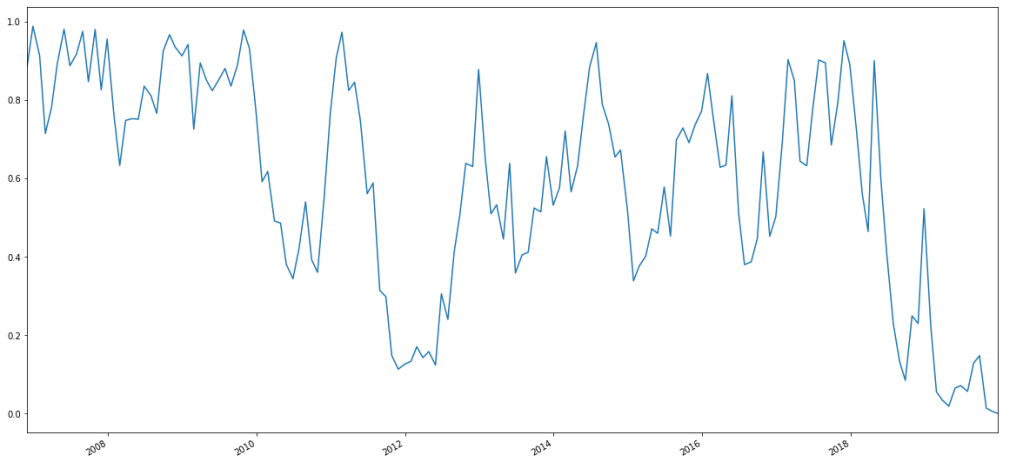

So, here’s some Python code to get our usual Adaptive Asset Allocation universe.

Anyhow, here’s something I found interesting, when trying to port over R’s endpoints function. Namely, in that while looking for a way to get the monthly endpoints, I found the following line on StackOverflow:

So far, so good. Right? Well, here’s an edgy panda that pops up when I try to narrow the case down to weeks. Why? Because endpoints in R has that functionality, so for the sake of meticulousness, I simply decided to change up the line from monthly to weekly. Here’s *that* input and output.

Notice something funny? Instead of 2007-01-07, we get 2007-12-31. I even asked some people that use Python as their bread and butter (of which, hopefully, I will be one of soon) what was going on, and after some back and forth, it was found that the ISO standard has some weird edge cases relating to the final week of some years, and that the output is, apparently, correct, in that 2007-12-31 is apparently the first week of 2008 according to some ISO standard. Generally, when dealing with such edge cases in pandas (hence, edgy panda!), I look for another work-around. Thanks to help from Dr. Vaidyanathan, I got that workaround with the following input and output.

Now, *that* looks far more reasonable. With this, we can write a proper endpoints function.

Essentially, the function takes in 3 arguments: first, your basic data frame (or series–which is essentially just a time-indexed data frame in Python to my understanding).

Anyway, here’s how the function works (now in Python!) using the data in this post:

endpoints(rets, on = "weeks")[0:20]

Out[98]:

array([ 0, 2, 6, 9, 14, 18, 23, 28, 33, 38, 42, 47, 52, 57, 62, 67, 71,

76, 81, 86], dtype=int64)

endpoints(rets, on = "weeks", offset = 2)[0:20]

Out[99]:

array([ 2, 4, 8, 11, 16, 20, 25, 30, 35, 40, 44, 49, 54, 59, 64, 69, 73,

78, 83, 88], dtype=int64)

endpoints(rets, on = "months")

Out[100]:

array([ 0, 6, 26, 45, 67, 87, 109, 130, 151, 174, 193,

216, 237, 257, 278, 298, 318, 340, 361, 382, 404, 425,

446, 469, 488, 510, 530, 549, 571, 592, 612, 634, 656,

677, 698, 720, 740, 762, 781, 800, 823, 844, 864, 886,

907, 929, 950, 971, 992, 1014, 1034, 1053, 1076, 1096, 1117,

1139, 1159, 1182, 1203, 1224, 1245, 1266, 1286, 1306, 1328, 1348,

1370, 1391, 1412, 1435, 1454, 1475, 1496, 1516, 1537, 1556, 1576,

1598, 1620, 1640, 1662, 1684, 1704, 1727, 1747, 1768, 1789, 1808,

1829, 1850, 1871, 1892, 1914, 1935, 1956, 1979, 1998, 2020, 2040,

2059, 2081, 2102, 2122, 2144, 2166, 2187, 2208, 2230, 2250, 2272,

2291, 2311, 2333, 2354, 2375, 2397, 2417, 2440, 2461, 2482, 2503,

2524, 2544, 2563, 2586, 2605, 2627, 2649, 2669, 2692, 2712, 2734,

2755, 2775, 2796, 2815, 2836, 2857, 2879, 2900, 2921, 2944, 2963,

2986, 3007, 3026, 3047, 3066, 3087, 3108, 3130, 3150, 3172, 3194,

3214, 3237, 3257, 3263], dtype=int64)

endpoints(rets, on = "months", offset = 10)

Out[101]:

array([ 10, 16, 36, 55, 77, 97, 119, 140, 161, 184, 203,

226, 247, 267, 288, 308, 328, 350, 371, 392, 414, 435,

456, 479, 498, 520, 540, 559, 581, 602, 622, 644, 666,

687, 708, 730, 750, 772, 791, 810, 833, 854, 874, 896,

917, 939, 960, 981, 1002, 1024, 1044, 1063, 1086, 1106, 1127,

1149, 1169, 1192, 1213, 1234, 1255, 1276, 1296, 1316, 1338, 1358,

1380, 1401, 1422, 1445, 1464, 1485, 1506, 1526, 1547, 1566, 1586,

1608, 1630, 1650, 1672, 1694, 1714, 1737, 1757, 1778, 1799, 1818,

1839, 1860, 1881, 1902, 1924, 1945, 1966, 1989, 2008, 2030, 2050,

2069, 2091, 2112, 2132, 2154, 2176, 2197, 2218, 2240, 2260, 2282,

2301, 2321, 2343, 2364, 2385, 2407, 2427, 2450, 2471, 2492, 2513,

2534, 2554, 2573, 2596, 2615, 2637, 2659, 2679, 2702, 2722, 2744,

2765, 2785, 2806, 2825, 2846, 2867, 2889, 2910, 2931, 2954, 2973,

2996, 3017, 3036, 3057, 3076, 3097, 3118, 3140, 3160, 3182, 3204,

3224, 3247, 3263], dtype=int64)

endpoints(rets, on = "quarters")

Out[102]:

array([ 0, 6, 67, 130, 193, 257, 318, 382, 446, 510, 571,

634, 698, 762, 823, 886, 950, 1014, 1076, 1139, 1203, 1266,

1328, 1391, 1454, 1516, 1576, 1640, 1704, 1768, 1829, 1892, 1956,

2020, 2081, 2144, 2208, 2272, 2333, 2397, 2461, 2524, 2586, 2649,

2712, 2775, 2836, 2900, 2963, 3026, 3087, 3150, 3214, 3263],

dtype=int64)

endpoints(rets, on = "quarters", offset = 10)

Out[103]:

array([ 10, 16, 77, 140, 203, 267, 328, 392, 456, 520, 581,

644, 708, 772, 833, 896, 960, 1024, 1086, 1149, 1213, 1276,

1338, 1401, 1464, 1526, 1586, 1650, 1714, 1778, 1839, 1902, 1966,

2030, 2091, 2154, 2218, 2282, 2343, 2407, 2471, 2534, 2596, 2659,

2722, 2785, 2846, 2910, 2973, 3036, 3097, 3160, 3224, 3263],

dtype=int64)

So, that’s that. Endpoints, in Python. Eventually, I’ll try and port over Return.portfolio and charts.PerformanceSummary as well in the future.

Thanks for reading.

NOTE: I am currently enrolled in Thinkful’s python/PostGresSQL data science bootcamp while also actively looking for full-time (or long-term contract) opportunities in New York, Philadelphia, or remotely. If you know of an opportunity I may be a fit for, please don’t hesitate to contact me on my LinkedIn or just feel free to take my resume from my DropBox (and if you’d like, feel free to let me know how I can improve it).